What do NHIF Hospital Categories A, B and C Mean?

NHIF accredited hospitals that are contracted to provide inpatient medical cover for its members are grouped into 3 categories: A, B and C. (update: the categories have since been updated into just comprehensive and non-comprehensive)

As a NHIF registered member you need this information when selecting your facilities as it determines the amount NHIF will cover for your inpatient expenses.

Under Category A hospitals, you receive a full and comprehensive inpatient cover including for maternity and surgical services provided they’re fully paid compliant members.

This means you will not be required to pay anything on admission. Category A hospitals include all public hospitals, including:

Under Category B hospitals, you receive full and comprehensive inpatient cover similar to Category A but you may be required to co-pay where surgery is involved.

Category B hospitals include Private hospitals, Mission (Faith-based) hospitals and NGO hospitals.

Under Category C hospitals, NHIF covers only for specified daily benefits (e.g. bed charges). Category C hospitals include mainly Private hospitals, but some Mission (Faith-based/NGO) hospitals are also contracted under this category.

How to Identify a Hospital’s NHIF Category?

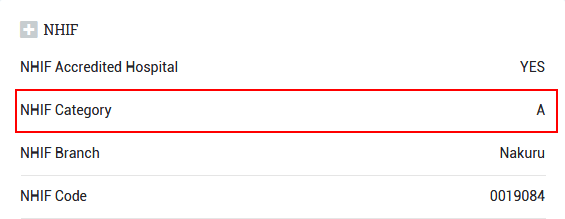

In the Profile tab of most facilities listed on HOSI, there’s an NHIF section where you can find the hospital category.

For hospitals that are not listed or that don’t have the category indicated, please visit the NHIF website and search for the hospital manually to find its category.

Note however that we source this information from the website which likely means if it’s not already indicated it may probably be missing on the NHIF website too.

For such cases, we recommend that you directly contact the hospital and ask them to provide you with this information using the contact information or social media pages available on their Profile tab.

You may also get this information by contacting NHIF via [email protected] or by calling 020 2723246 / 0800 720 601 (Toll Free).

Comments

Alfred

March 28, 2021 at 5:03 pmHow can I know how much I have spent on my NHIF

stella mukami

August 2, 2021 at 12:53 pmI added a dependant on Friday last week and was told to wait until Monday for it to reflect but up to now the dependant has not been added,what might be the problem?

Mercy Mwaura

April 18, 2022 at 2:41 pmHello my question is ,how much does NHIF cover for outpatient? Since I went to hospital and I was told the only amount which can be paid by my nhif card it ksh 500 so, this left me into wonder because I even pay more than 500 ksh per month, kindly advise me onto this.

Benjamin

May 23, 2022 at 5:51 pmMy grandparents was admitted for 3 days and the total bill was 42000 but NHIF paid 5400 only is it logic ? I better save monthly and cater for my bills when i become sick

-

jesse

June 7, 2022 at 3:32 pmYou should be grateful, 500/- monthly contributions and you’re getting 5400/- in 3 days. smh!. How i wish people should cease overlooking what they get in return from the Fund. Take a scenario that you’ve contributed for just one year, i.e Ksh6000, an emergency arises and NHIF raises 100k-300k for your procedure, how about that? how does it feel? I mean, we should learn to gratitude. Ive seen people struggling to pay hospital bills just because of blissful ignorance.

-

Jenn

June 8, 2022 at 11:22 amWhat the hell comment is this. Thats what makeshift an insuarance fund. Most people pay it but never get to use it as well and such money should cater for those who do need it regularly. Have a soul

-

-

Husna

February 18, 2023 at 12:12 pmmy friend and do you know for how long he paid that 500 without getting sick

Husna

February 18, 2023 at 12:11 pmimagine nhif is better to use in agovernment hospital,it Carter for everything rather than private hospital.that is if your in category A which is 500

Jose

January 27, 2023 at 2:53 pmI have been paying my NHIF since last year now it’s one year my child git sick and admitted at KNH ICU in uthaya nyeri and now they are telling me that NHIF can’t clear all bills I pay 5000 and they pay only for the bed is this how it goes

David Mujur

March 12, 2024 at 11:04 pmMy spouse has been discharged from KNH after kidney problems and subjected to surgery and incurred a bill of Ksh 903,000.How much would the scheme cater to a avoid the drudgery of hosting a fund raiser?

David Mujur

March 12, 2024 at 11:06 pmMy spouse has been discharged from KNH after kidney problems and subjected to surgery and incurred a bill of Ksh 903,000.How much would the scheme cater to a avoid the drudgery of hosting a fund raiser? Waiting for feedback please!

Irene Ilaria

February 4, 2021 at 5:11 pmI was happy With Nhif from the time I started using it…but today am a disappointed client after I visited a hospital and I was told I don’t have funds for out-patient’s services..

I have been going to many hospitals and have never been told about that..

I was informed that my outpatient cover is only 100,000kshs and I have exhausted it from July to date.My questions is,how much is allocated for a civil servant in job group”L”,and how is is calculated?I have previously visited other hospitals and I have never been told that,even when I was in lower job groups..There is something that has to be elaborated for clients to understand..

Thank you

Hosi

February 5, 2021 at 11:05 amHello Irene,

Sorry to hear about your experience. I’ve looked into the limits for job group ‘L’ in the Civil Servants Handbook that’s available here and it seems they’re correct – the outpatient limit is 100,000 and in-patient limit is 1,000,000. Only job groups A-K have unlimited limits for both.

Luke Okongo Nyagowa

March 31, 2023 at 5:58 pmLike it